Overview

- Act: Retirement Benefits Act, No. 3 of 1997

- Formed: 1999

- CEO: Charles Machira

- X (Twitter)

- YouTube

The Retirement Benefits Authority (RBA) was established under the Retirement Benefits Act, No. 3 of 1997 and began operations in 1999. It regulates, supervises, and promotes Kenya’s retirement benefits sector to ensure efficiency, transparency, and security of pension funds. RBA licenses pension schemes and administrators, enforces compliance, and protects members’ interests. It also educates the public on retirement planning and advises the government on pension policies. By fostering a well-regulated and sustainable pension system, RBA enhances financial security for retirees and contributes to Kenya’s socio-economic development.

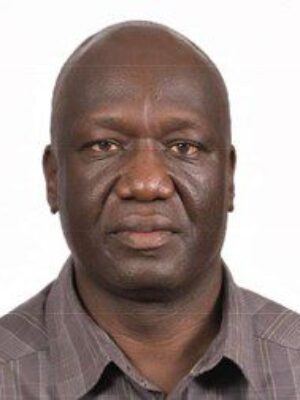

CEO: Charles Machira

Mr. Machira holds a Bachelor’s in Mathematics and Statistics (Moi University)

and a Master’s in Social Protection Finance. With 20+ years’ experience in the insurance and pension sectors, he was Chief Manager, Supervision at RBA for 11 years and previously served as Managing Trustee, Policyholders Compensation Fund.

Management Team

Charles Machira

CEO

Simon Kiplangat

Director, Corporate Services

Jackson Nguthu

Director, Supervision

Lazarus Kisia Keizi

Ag. Director, Research, Strategy and Planning

Elizabeth T. N. Waruingi

Director, Internal Audit and Risk Assurance

Praxidis Saisi

Director, Legal Services and Corporation Secretary

Tom K. Kiptanui

Ag. Director, Market Conduct & Industry Development

Gordon Bulinda

Deputy Director, Human Resources and Administration

George Ogwang

Deputy Director, Supply Chain Management

Peter K Ngunyi

Deputy Director, Information and Communications Technology

Sarah Khamala Baraza

Deputy Director, Finance & Accounts

James Ratemo

Assistant Director Corporate Communications

Board of Governors

Nelson Havi

Chairman

Charles Machira

CEO

Ambrose R. Ogango

Director and Head of the Financial Unit at the National Treasury

Wyckliffe M. Shamiah

Director & CEO Capital Markets Authority

Godfrey K. Kiptum

Director & CEO Insurance Regulatory Authority

Jeremiah K. Kendagor

Board Member

Dr. Jane Nyokabi Njuguna

Board Member

Joseph Kiborus Tarus

Board Member

Ibrahim M. Salat

Board Member

Praxidis Saisi

Director, Legal Services and Corporation Secretary

Functions

- Regulating and Supervising the Retirement Benefits Sector – Ensures compliance with the Retirement Benefits Act, No. 3 of 1997.

- Licensing Pension Schemes and Service Providers – Approves and regulates pension schemes, trustees, administrators, and fund managers.

- Protecting Pension Members’ Interests – Safeguards retirement savings against mismanagement and fraud.

- Ensuring Compliance – Enforces pension laws and takes action against non-compliance.

- Promoting Public Awareness – Educates Kenyans on the importance of retirement planning.

- Advising the Government – Provides policy recommendations on pensions and social security reforms.

- Encouraging Retirement Savings Growth – Supports pension sector expansion and financial inclusion.

- Monitoring Fund Performance – Ensures pension funds maintain financial stability and sustainability.

- Handling Complaints and Disputes – Resolves grievances related to pension schemes.

- Fostering Regional and International Collaboration – Works with global regulators to align with best pension practices.

Important Links

Address & Contacts

- Retirement Benefits Authority, Rahimtulla Tower, 13th Floor, Upper Hill Road, Opp UK High Commission.

- P.O. Box 57733 – 00200 Nairobi, Kenya.

- info@rba.go.ke

- +254 (20) 2809000| 0722509939| 0726600001 | 0726600002